A jobber (fuel supplier) doesn’t simply supply gas anymore. These days more and more jobbers are offering additional services to the stores they work with daily. From pre-negotiated pump repair services, to pre-negotiated lawn mowing services, parking lot management, POS fees, power washing services and more. After negotiating rates with their service suppliers, usually the jobber would add these expenses to the bill sent to the gas station.

So, instead of getting charged only for gas and related costs (delivery for example), gas station owners may be charged additionally for various non-fuel related services. These additions expenses need to be assigned to non-fuel/general store maintenance expenses in the store’s financial reports.

Keeping up with this trend, we have adjusted our fuel management system to support this expense allocation need. Simply done, when entering a fuel bill, you can now split the amount into fuel related costs and non-fuel related costs. Non-fuel expenses will automatically be adjusted by CStorePro against the store’s P&L report and expense list. The fuel related expenses allocation in the system hasn’t changed, counted against your fuel profit.

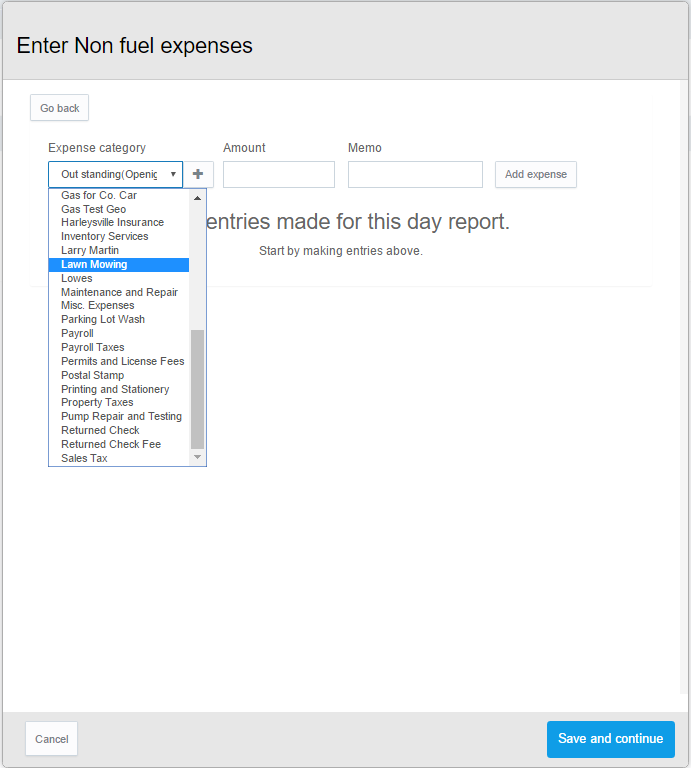

In the interface under Gas>Payments>"Add new", instead of a single text field for miscellaneous expenses, you can create multiple custom categories for your expenses, based on their type, by clicking on the edit box next to “Fuel Expenses” (formally-“Other charges”) and choosing an existing category from the drop down menu or creating a new one (by clicking on “+”):

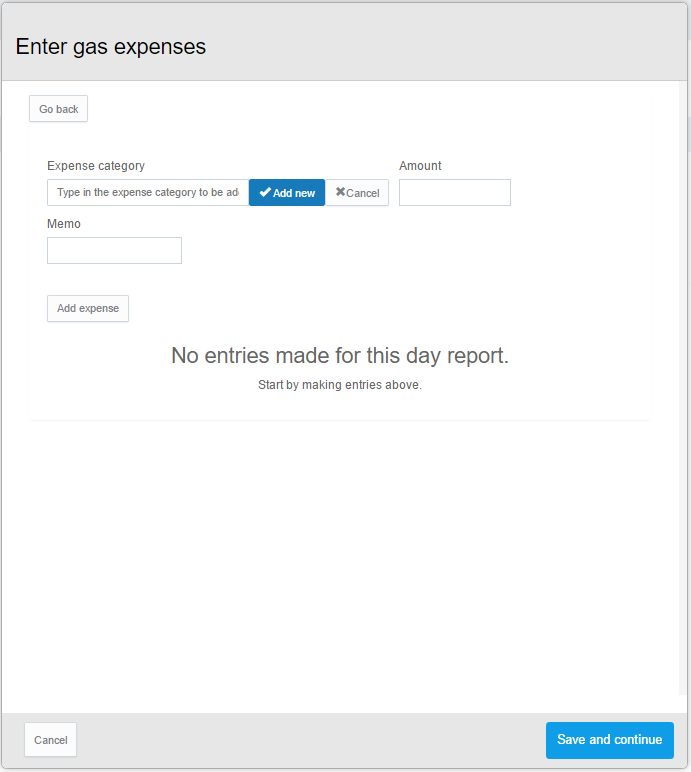

You can also categorize your fuel related expenses the same way:

For more information and step by step instructions on how to enter a gas payment, click here.